e. administering medication physical or mental therapy assisting with personal hygiene dressing bathing etc. Describe the services you provide Are you a licensed health professional RN LVN or LPN If Yes provide your license number Section 3 Nursing Home Information Is your facility licensed by the State Is the patient in your nursing home because of a physical or mental disability Do you provide either skilled or intermediate level nursing care to the patient What was the admitting diagnosis Sec .

DocHub Reviews 44 reviews DocHub Reviews 23 ratings 100,000+ users

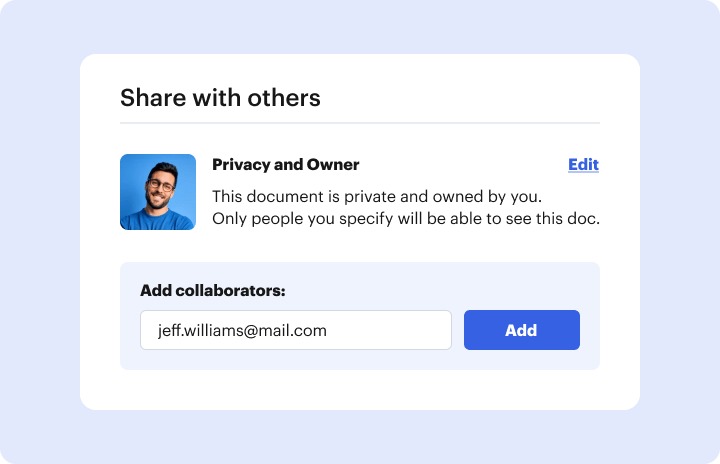

Send child care expenses example via email, link, or fax. You can also download it, export it or print it out.

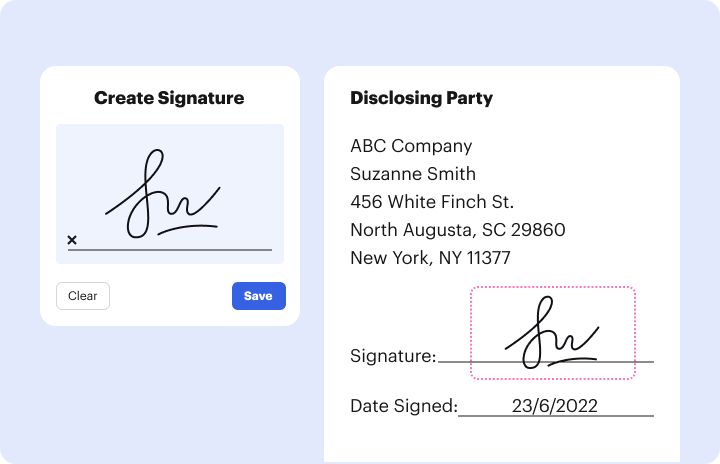

Dochub is a perfect editor for modifying your forms online. Adhere to this straightforward guideline edit Va child care expense statement in PDF format online at no cost:

Try all the benefits of our editor today!

Fill out va child care expense statement onlineWe have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

What is not included in debt-to-income ratio?What payments should not be included in debt-to-income ratio? The following payments should not be included: Monthly utilities, like water, garbage, electricity or gas bills. Car Insurance expenses.

What is included in debt-to-income ratio?To calculate your debt-to-income ratio, add up all of your monthly debts \u2013 rent or mortgage payments, student loans, personal loans, auto loans, credit card payments, child support, alimony, etc. \u2013 and divide the sum by your monthly income.

What is VA child care?Virginia's Child Care Subsidy Program provides financial assistance to low-income, eligible families to help pay a portion of child care costs so families can work or participate in education programs.

What does your debt-to-income ratio have to be for a VA loan?The debt-to-income ratio determines if you can qualify for VA loans. The acceptable debt-to-income ratio for a VA loan is 41%. Generally, debt-to-income ratio refers to the percentage of your gross monthly income that goes towards debts. In fact, it is the ratio of your monthly debt obligations to gross monthly income.

What is VA childcare letter?A child care letter is required on a VA loan if the borrower has children under the age of 12. A VA loan requires that childcare expenses are counted as liabilities for qualification purposes. The letter states what if any child care costs are incurred each month, and if none are incurred the reason.

va child care expense letter pdf va child care statement requirements va handbook child care expenses va child care letter sample navy federal child care expense letter blank child care letter

MATH 131 3/07 completed is related to his/her place of residence. A sample of 1000 people is selected and classi ed as .

Co-occurring Disorders Treatment Workbook -. - / 0 1 2 3-456 0748 9 - 3 - 49 -. - / 8 4 7 4 84 6 7 / - 49 2002 The .

To calculate your debt-to-income ratio, add up all of your monthly debts \u2013 rent or mortgage payments, student loans, personal loans, auto loans, credit card payments, child support, alimony, etc. \u2013 and divide the sum by your monthly income.

What is included in debt-to-income ratio for VA loan?The debt-to-income ratio determines if you can qualify for VA loans. The acceptable debt-to-income ratio for a VA loan is 41%. Generally, debt-to-income ratio refers to the percentage of your gross monthly income that goes towards debts. In fact, it is the ratio of your monthly debt obligations to gross monthly income.

What is included in debt-to-income ratio for VA loan?The debt-to-income ratio determines if you can qualify for VA loans. The acceptable debt-to-income ratio for a VA loan is 41%. Generally, debt-to-income ratio refers to the percentage of your gross monthly income that goes towards debts. In fact, it is the ratio of your monthly debt obligations to gross monthly income.

Does VA have a front end ratio?The front-end ratio is a direct correlation between your home payments and your income, and lenders will use this to see if you can afford a larger loan. Most lenders will want to see a front-end ratio of 28 percent or lower before approving a mortgage. The VA won't impose limits on your loan amount.

What is the qualifying ratio for VA?VA guidelines suggest that the debt-to-income ratio generally should be no more than 41 percent. However, if the ratio is greater than 41 percent, lenders can still approve the VA loan by considering the borrower's other credit factors.

conviction of a felony. The amount not payable may be apportioned to a spouse, dependent children or parents. 6. Monthly payments of your .

2. Income – Required Documentation and Analysis9, How to Complete VA Form 26-6393, Loan Analysis, 4-64 . lender is responsible for determining if there are any child care expenses for the borrower(s).

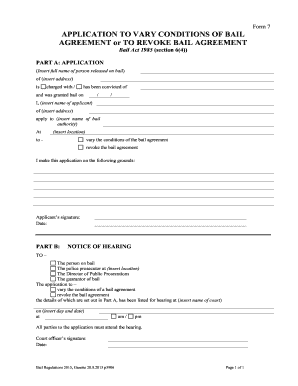

38 CFR § 36.4340 - Underwriting standards, processing .The statement must be signed by the underwriter's supervisor. It must be stressed that the statute requires not only consideration of a veteran's present and .