Standard Maine Residential Lease Agreement Template_1 on iPropertyManagement.com" width="1224" height="1584" />

Standard Maine Residential Lease Agreement Template_1 on iPropertyManagement.com" width="1224" height="1584" />  Standard Maine Residential Lease Agreement Template_1 on iPropertyManagement.com" width="1224" height="1584" />

Standard Maine Residential Lease Agreement Template_1 on iPropertyManagement.com" width="1224" height="1584" />

A Maine rental agreement is a legal contract between a landlord overseeing a rental property and a tenant who wishes to use it. Maine landlord-tenant law governs these agreements; rental terms must be within the limits allowed by law.

A Maine residential lease agreement (“rental agreement”) is a legal contract for a tenant to rent a residential property from a landlord, subject to terms and conditions agreed by all parties.

A Maine month-to-month lease agreement is a contract (not necessarily written) where a tenant rents property from a landlord. The full rental term is one month, renewable on a month-to-month basis.

Maine landlords may use a rental application form to screen prospective tenants. A rental application collects information relating to finances, rental history, and past evictions.

A Maine sublease agreement is a legal contract where a tenant ("sublessor") rents (“subleases”) property to a new tenant (“sublessee”), usually with the landlord’s permission.

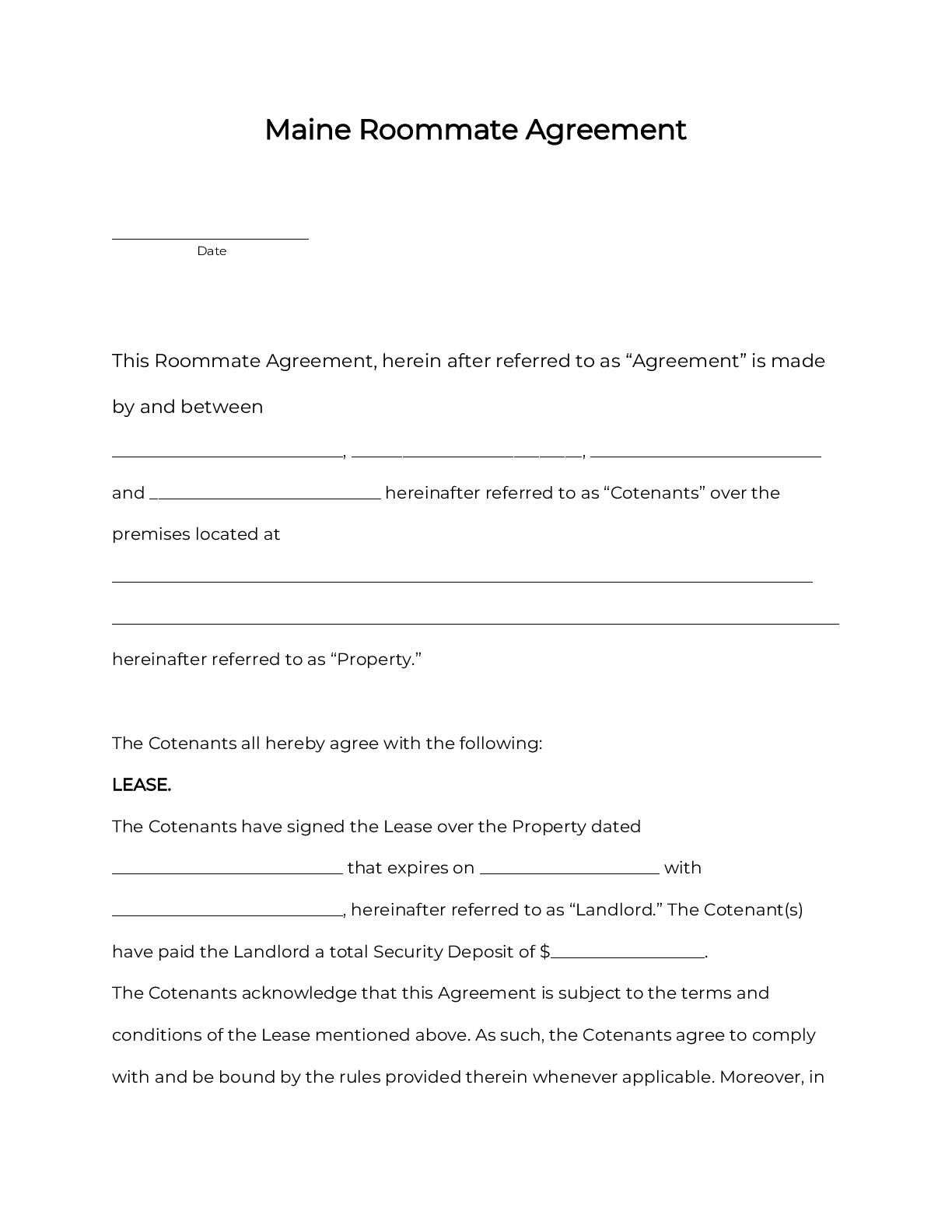

A Maine roommate agreement is a legal contract between two or more people (“co-tenants”) who share a rental property according to rules they set, including for things like splitting the rent. This agreement binds the co-tenants living together, and doesn’t include the landlord.

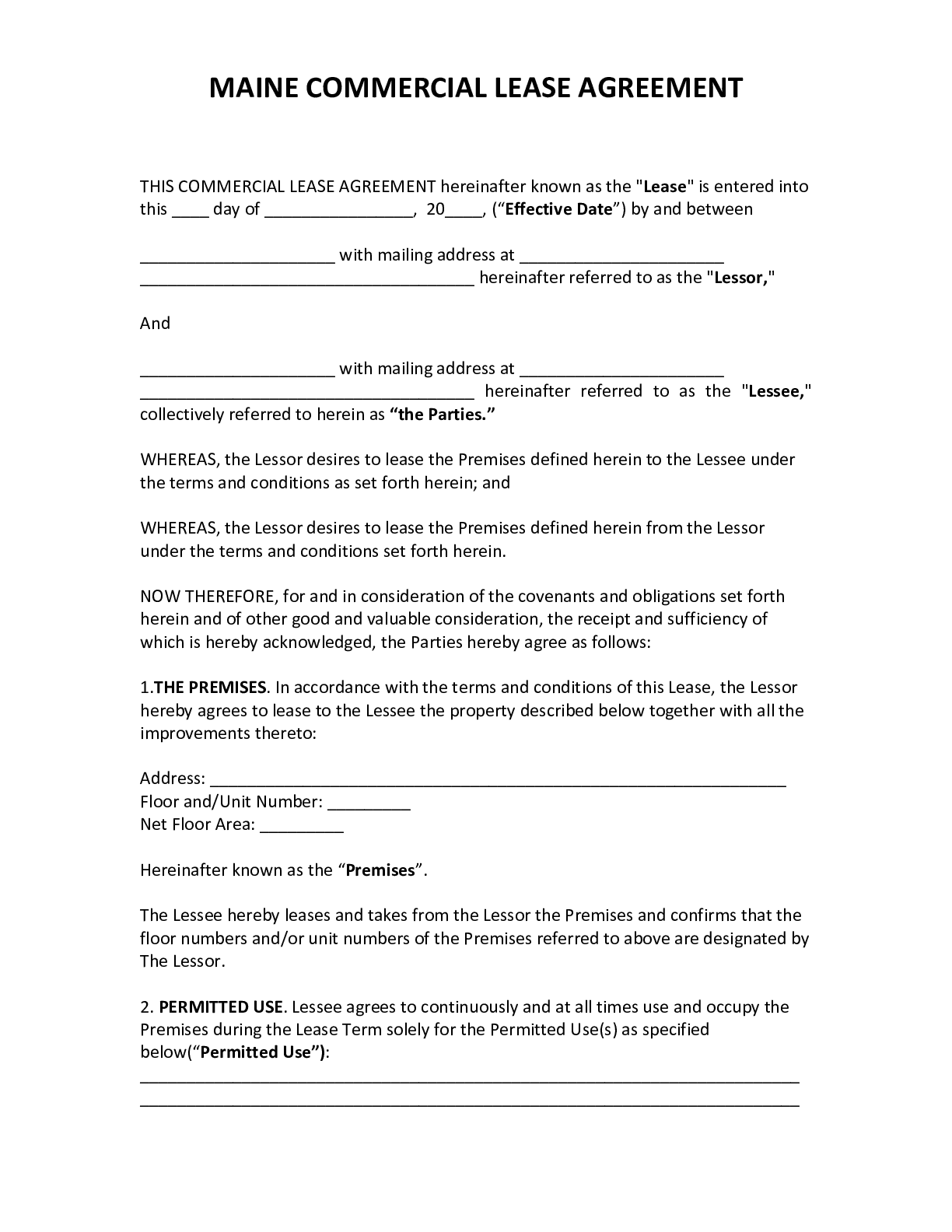

A Maine commercial lease agreement is a legal contract arranging the rental of commercial space between a landlord and a business.

To learn more about required disclosures in Maine, click here.

To learn more about landlord tenant laws in Maine, click here.

1. Energy efficiency disclosure. A prospective tenant who will be paying utility costs has the right to obtain from an energy supplier for the unit offered for rental the amount of consumption and the cost of that consumption for the prior 12-month period. A landlord or other person who on behalf of a landlord enters into a lease or tenancy at will agreement for residential property that will be used by a tenant or lessee as a primary residence shall provide to potential tenants or lessees who pay for an energy supply for the unit or upon request by a tenant or lessee a residential energy efficiency disclosure statement in accordance with Title 35‑A, section 10117, subsection 1 that includes, but is not limited to, information about the energy efficiency of the property. Alternatively, the landlord may include in the application for the residential property the name of each supplier of energy that previously supplied the unit, if known, and the following statement: “You have the right to obtain a 12-month history of energy consumption and the cost of that consumption from the energy supplier.”

2. Provision of statement. A landlord or other person who on behalf of a landlord enters into a lease or tenancy at will agreement shall provide the residential energy efficiency disclosure statement required under subsection 1 in accordance with this subsection. The landlord or other person who on behalf of a landlord enters into a lease or tenancy at will agreement shall provide the statement to any person who requests the statement in person. Before a tenant or lessee enters into a contract or pays a deposit to rent or lease a property, the landlord or other person who on behalf of a landlord enters into a lease or tenancy at will agreement shall provide the statement to the tenant or lessee, obtain the tenant’s or lessee’s signature on the statement and sign the statement. The landlord or other person who on behalf of a landlord enters into a lease or tenancy at will agreement shall retain the signed statement for a minimum of 3 years.

1. Definitions. As used in this section, unless the context otherwise indicates, the following terms have the following meanings. A. “Mandatory recurring fee” has the same meaning as in section 6000, subsection1-A. B. “Optional recurring fee” has the same meaning as in section 6030-I, subsection 1. C. “Rent” has the same meaning as in section 6000, subsection 1-B. D. “Utility service costs” has the same meaning as in section 6000, subsection 3-A.

2. Written disclosure prior to tenancy. Notwithstanding any other provision of this chapter, prior to entering a lease or tenancy at will agreement, a landlord shall provide a potential tenant or lessee written disclosure of the costs the tenant or lessee will be responsible for paying pursuant to the lease or tenancy at will agreement that contains at a minimum the following: A. The total cost of rent; B. Any mandatory recurring fee; C. Any optional recurring fee; D. Any utility service costs; and E. Any other cost that the tenant will be responsible for paying pursuant to the lease or tenancy at will agreement.The disclosure must be plain and readily understandable by the general public. If a landlord is unable to obtain utility service costs for a dwelling unit, the landlord may provide a completed residential rental energy efficiency disclosure statement in accordance with Title35‑A, section 10117, subsection 1. The disclosure must be signed by both parties, with a copy provided to each.

3. Exception. A written disclosure under subsection 2 is not required if the tenant is not responsible for paying any mandatory recurring fee or any optional recurring fee.

Sec. 13. Effective date. This Act takes effect January 1, 2025.